The new financial regulator enjoys revealed more challenging serviceability assessment getting mortgage brokers, in order to make it more challenging for the majority of consumers to obtain an effective financial, on a single go out the new Set aside Lender of the latest Zealand starts lifting its benchmark interest rate.

Key points:

- Banks would need to use a slightly harder attempt to the good borrower’s power to afford home loan repayments

- APRA can be involved in regards to the amount of buyers borrowing from the bank over six minutes its pre-tax money and that flow often restrict one

- Home-based home beliefs features popped 20.step 3 percent when you look at the past one year

From inside the a letter so you can banking companies for the Wednesday, the brand new Australian Prudential Control Expert (APRA) has grown minimal interest rate boundary to your mortgage software away from dos.5 to three fee points.

“All ADIs [authorised deposit delivering organizations] are going to be working with a shield with a minimum of step 3 payment issues over the loan interest rate,” brand new regulator cautioned on page.

“The latest shield will bring an essential backup for goes up inside the rates across the longevity of the mortgage, as well as for any unanticipated changes in good borrower’s money otherwise expenditures.

“Where ADIs consistently approve finance having fun with a lowered buffer speed outside of the prevent out-of , APRA commonly to switch individual prudential resource requirements to echo large borrowing chance intrinsic into the the latest credit.”

How much does they imply?

This is why, out of November, financial institutions would have to try if brand new individuals can invariably afford its mortgage payments if the financial interest rates rose getting step 3 fee affairs above their current rates.

Put differently, if you removed a mortgage with an intention price away from dos % toward November step 1, the bank might possibly be review to find out if you really can afford and then make costs having a great 5 % interest. If you could not, the mortgage software will be refused.

Whenever they avoid using which higher attempt, they are economically penalised insurance firms to hang significantly more reserves against loss, which would beat their success.

For home loan candidates, this means the most anyone normally acquire according to its earnings and you can costs might possibly be below it absolutely was in dated serviceability test out-of 2.5 per cent.

Rates ascending to another country

New Reserve Financial of brand new Zealand ‘s the current main financial to https://clickcashadvance.com/loans/get-a-personal-loan-with-no-credit-history/ increase rates, lifting their benchmark of an archive reasonable 0.twenty-five percent so you can 0.5 percent.

Their move occurs the back of ascending inflation challenges and you will the nation’s very own homes growth, that has viewed rates increase up to 29 % along the past 12 months, even after moves earlier this seasons to help you include them.

Housing growth crackdown?

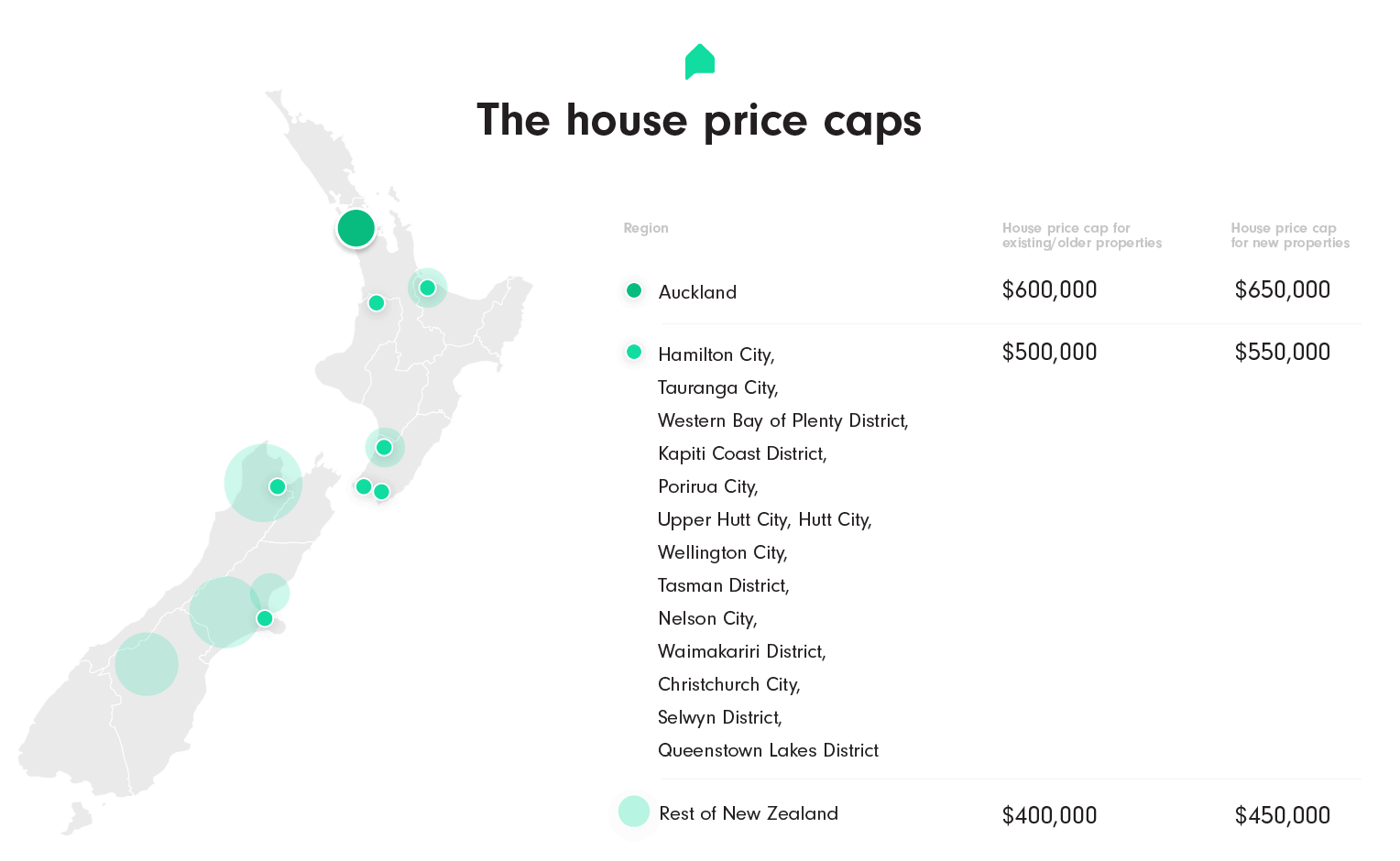

The brand new Zealand is during a great deal larger homes growth than Australian continent immediately, however, authorities features gone to live in avoid it.

“Members listed that a number of situations are expected to help you constrain family pricing along side average term. They truly are a higher level away from home building, slowly people progress, change so you’re able to income tax setup, and you can firmer lender credit statutes,” the brand new statement proceeded.

“Participants detailed a threat one any proceeded close-term rate increases may lead to sharper drops in house prices down the road.”

Despite the constant COVID break out, The new Zealand has registered Southern area Korea and you will Norway as the build economic climates which have become swinging rates off pandemic downs.

Casing risks mounting around australia

APRA chairman Wayne Byres said the fresh new circulate is actually intended to lead out of strengthening dangers off an increasing number of huge mortgages.

“Since the banking system are better capitalised and you will credit requirements full has actually held up, expands on display out-of heavily with debt consumers, and you may power throughout the household business a lot more generally, signify medium-identity risks to monetary balance was building,” he indexed.

Recent Comments